You can find lots of Flagstaff real estate agent to give you optimistic advice; and there are some pessimists. I strive to be the realist. I hope you see that in my Monthly Flagstaff Real Estate Reports. This past week, I’ve been reading about national trends from a variety of analysts.

National Association of Realtors®

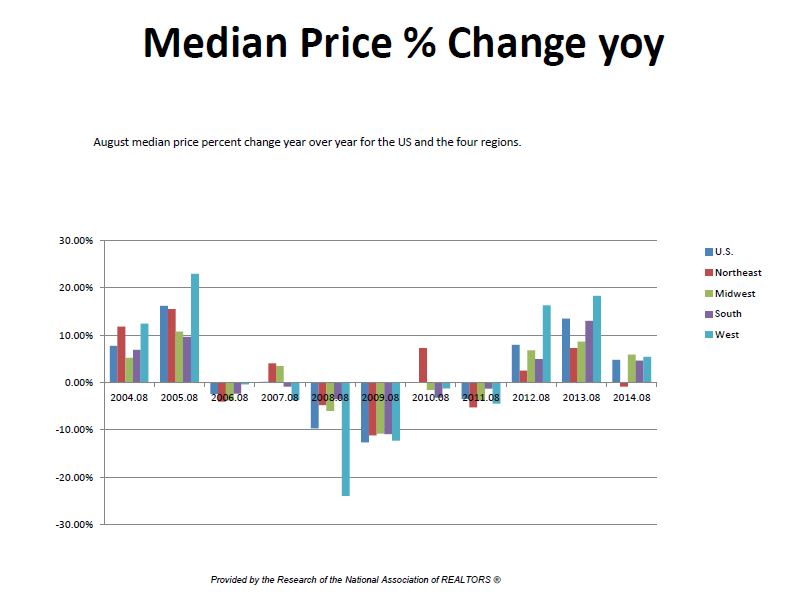

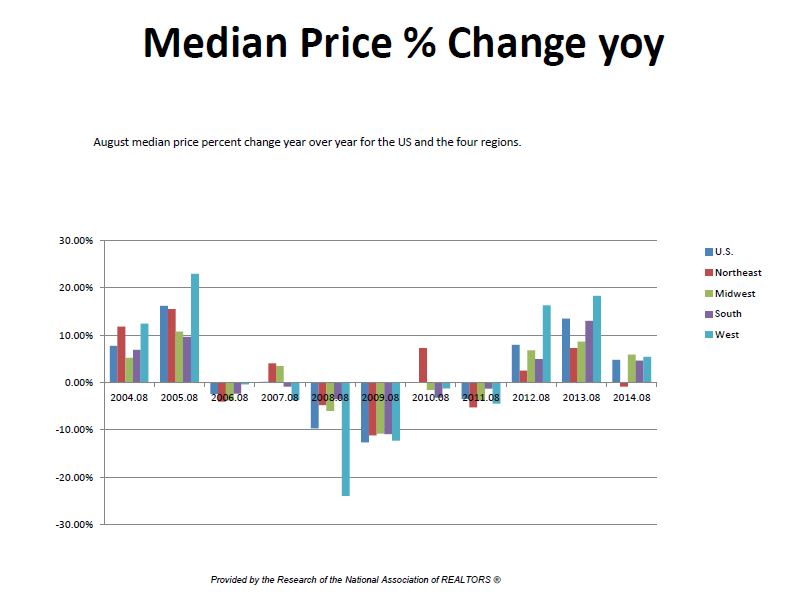

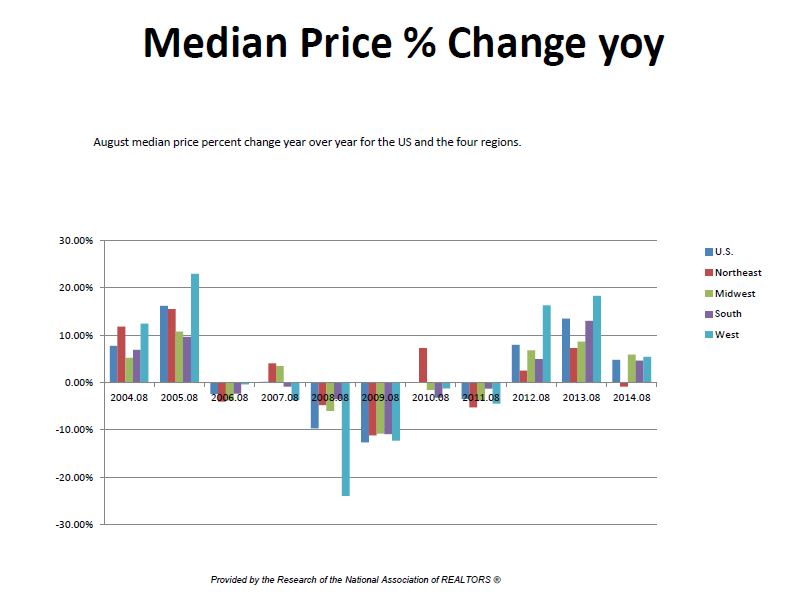

The National Association of Realtors® gathers data from all the multiple-listing services in the country. Like other sources, this data lags by a month what I can give in reporting on our local Flagstaff home sales market. An NAR economist provided some 10-year data that, I think, gives an interesting perspective on where our market is now. Of particular note is that 2014 has not produced home price increases as high as those produced in 2013.

Here are other highlights of the NAR housing data:

- Total homes sold in the United States for August 2014 is slightly below the ten-year average. That’s true for the West Region, where Arizona is. The Midwest and the South are the only two regions to show current sales above the ten-year August average.

- Regionally, since the low point of sales in 2010, there had been three consecutive year-over-year gains, but that changed this year with sales declining in August.

- The median home price in August 2014 is higher than the ten-year August average median price for the U.S. and all four regions. The West leads all regions with the highest home prices. (That may be why fewer homes are being sold in the West.)

- The median price year-over-year percentage change shows prices having a positive change for the last three years after struggling the previous six years. The West has predominately guided the direction of home prices for the U.S. and all regions over the ten-year cycle. For the U.S. and the four regions the best price percentage increase took place in 2005 except for the South, which had its best gains in 2013. The biggest decline took place in 2009 for all U.S regions except the West, which had the largest drop in 2008 when home values declined more than 20%. This August the Midwest is the only region to have a negative year-over-year price percentage change.

CoreLogic

CoreLogic is a data supply company that split off from First American in 2010. CoreLogic’s real estate data is drawn from public records and propriety sources. According to CoreLogic, as reported by MarketWatch.com, year-over-year home-price growth fell to 6.4% in August, down from 6.8% in July and 11.4% in August 2013. The firm expects housing appreciation is expected to slow down even further, with annual growth in August 2015 hitting 5.2%.

Annual home-price growth in major cities is slowing down, with many still substantially below peak prices. Nationally, home prices in August were down 12.1% from a 2006 peak, according to CoreLogic.

CoreLogic data on the mortgage market suggests that severe credit tightening in 2014 is holding back the housing market. In May, credit availability for all home loans was half of what it was in the late 1990’s, when the housing market was making steady gains much like today, according to the firm’s Housing Credit Index.

Anthony B. Sanders, an economics professor at George Mason University, isn’t the only economist who has said lately that it’s not the credit availability that is the problem. Sanders recently said the main issue in the housing market is the income of borrowers, not the standards of lenders. He said the subprime collapse in 2008 damaged the finances of borrowers and that incomes, particularly for low-wage workers, have been stagnant.

RE/MAX CEO

Dave Liniger, the Chief Executive Officer of RE/MAX International, has been following housing trends since the early 1970’s. In the 11 years that I’ve been following him, his predictions have not been wrong. He sees a fairly flat market ahead into the middle of 2015 when the volume of sales will increase and continue strong through 2016-2017. What that means for prices is a local market matter – remember all real estate is local.

When you need some good advice about Flagstaff real estate, contact us: The Elite Team at RE/MAX Peak Properties.

Related:

Tight mortgage credit and stagnant wages a one-two punch for housing | Inman News.

Home-price growth hits slowest pace in nearly two years – MarketWatch.

Tightest Credit Market in 16 Years Rejects Bernanke’s Bid – Bloomberg News