Buying a home can be one of the biggest investments you make in your lifetime. There are a lot of moving parts and a lot to consider while making this investment. The Elite Team at RE/MAX Peak Properties is always happy to guide buyers through the process, whether it is your first time purchasing or if you are a home-buying veteran, we are here to help with your Flagstaff real estate purchase. Here we will provide some information that can get you started and some things to consider while you are considering buying a home in Flagstaff.

Buying a home can be one of the biggest investments you make in your lifetime. There are a lot of moving parts and a lot to consider while making this investment. The Elite Team at RE/MAX Peak Properties is always happy to guide buyers through the process, whether it is your first time purchasing or if you are a home-buying veteran, we are here to help with your Flagstaff real estate purchase. Here we will provide some information that can get you started and some things to consider while you are considering buying a home in Flagstaff.

The first thing you will want to do as a buyer is to find out what you qualify for and what a comfortable house payment will be.

We have a lot of trusted lenders that can help you with the process. The lender will start by getting some important information from you regarding your credit, debt, work history, down payment and residential history.

Freddie Mac describes the 4 C’s that help determine how much a buyer will be qualified to borrow:

- Capacity: Your current and future ability to make your payments.

- Capital or Cash Reserves: The money, savings and investments you have that can be sold quickly for cash.

- Collateral: The home, or type of home, that you would like to purchase.

- Credit: Your history of paying bills and other debts on time.

Once you have your prequalification form, you and your real estate agent can get started finding the perfect home for you.

A good agent will be able to sit down with a buyer and explain what is available to them in their local real estate market. The agent can explain what different neighborhoods have to offer; what you can expect when you purchase a townhome or a manufactured home; and different challenges that might arise. The agent will ask you to think about your “must-haves,” “should-haves” and “absolute-wish list.” Basically, the agent will provide you with all of the pertinent information to allow you to make a very informed decision.

Next, the fun of looking at homes starts!

You and your agent will begin looking at homes. An experienced agent will point out good and bad things about each house that a buyer may not know to look for. An important document that a REALTOR® should give a buyer before they start looking is the Buyer Advisory. This is a great source of information that informs buyers of all the things they will want to consider while purchasing a home in Arizona.

Once a buyer has found a home that they are ready to make an offer on, they will sit down with their agent and discuss formulating an educated offer.

The agent will show the buyer the recent comparables to determine a fair offering price. There are other things that can be negotiated and need to be considered, in a purchase contract. You will want to consider your closing date, if there is any personal property that you will want to ask for, if you want to ask the seller to help with your closing costs, etc. Your agent will walk you through this process in order to make the offer that makes the most sense for you. You will also want to consider what is happening in your local market area. Are you in a buyer’s market or a seller’s market? This will affect your offering strategies and how you will want to proceed on certain homes.

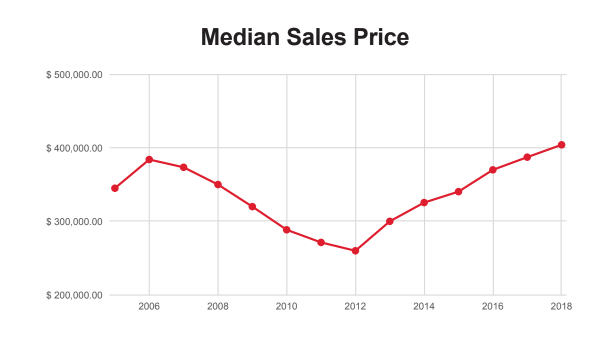

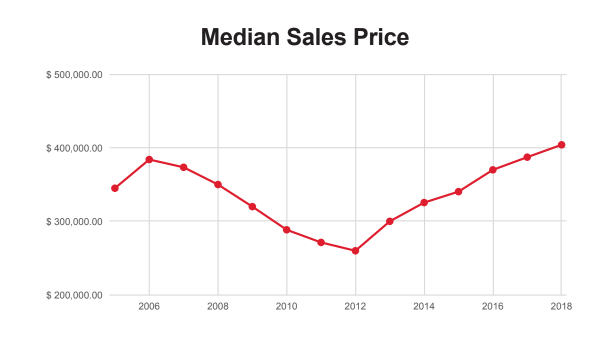

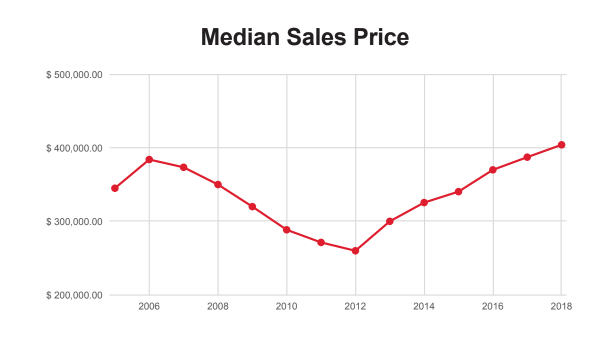

Currently, the Flagstaff market is still considered a seller’s market, especially in certain price points. There is low inventory under the $500,000 price range and there are a lot of buyers who are looking in this price range. Basic economics will tell you that low inventory and high demand will drive prices up. It also forces buyers to be aggressive in their home hunt. A good agent can help you formulate an aggressive, sometimes creative, offer to help you beat out the competition. The chart below shows what the prices have looked like over the past several years in Flagstaff, AZ.

Once you have located a home and have had an offer accepted, the escrow period starts.

During the escrow period, your agent will navigate you through the important steps of ensuring that this is the home you want to buy and that everything is in order for closing day. The most important part of the escrow period is your inspection period. As a buyer, you will have a set amount of time after offer acceptance to determine if you are completely comfortable with your purchase. You will want to have different inspections done by licensed inspectors. A few examples of inspections you may want to have are a home inspection, a pest inspection, and a radon test. The home inspector will visually inspect all aspects of the home and recommend further inspections if necessary. The pest inspector will check the house for current pest infestation and also aspects of the home that may cause future pest infestation. The radon test will determine radon levels in the house. Some other inspections that buyers may consider are mold inspections, lead-based paint inspections, structural inspections, etc. The inspection period is also the time to obtain homeowner’s insurance quotes and to ensure you are not in a flood zone. Both of these things will affect your monthly payment. At the end of the inspection period, you have the opportunity to renegotiate based on any of your findings.

Also, during your escrow period your agent, lender and escrow officer will be working as a team to do everything behind the scenes to get the home to the closing table.

After all contingencies have been met and the loan process is complete, the buyer will be ready to sign their loan documents and close on their property.

Once the property has closed and the documents have been recorded with the county recorder, the agent will give the buyer their keys.

It is always an exciting day when a buyer gets their new keys! We as REALTORS® love seeing the excitement in our buyer’s faces when they are able to get the keys and start moving in. Though it is a long and intensive process, it is worth it in the end and we are here to make it as stress-free as possible. Contact our team with any questions. We are ready to help you find your dream home.